Is this the start of something big?

Each year, ICDP produces the ‘magnum opus’ of European distribution networks – the European Car Distribution Handbook (ECDH) that profiles the size of franchised sales and service networks for now 50 brands across 35 European markets. The Handbook was first published in 2007, so provides a long history of the evolution of networks, with brands and markets added (and occasionally removed) to reflect our changing landscape. It’s produced with the support of the manufacturers who are the primary source of the data, and used by their network planners for benchmarking, as well as by others in the industry who need to understand their target markets if they are selling goods or services into the dealer networks in Europe.

Over the years we have continuously commented on how the actual size of networks has barely changed year-on-year despite the frequent announcements from different brands that they are going to restructure or rationalise their networks. Such actions would in our view be justified as dealer economics (indicated in ECDH by new car sales per dealer) falls well short in Europe of other significant markets like China and the USA, and average drive times with the current network densities are far in excess of what car buyers tell us would be their maximum for either buying or servicing their car. You can read more about that in my blog from May. That would suggest that there is both a need and an opportunity to reduce networks significantly for the established brands.

It’s worth saying that we are actually measuring franchise points, not rooftops or investors, so a combined Renault Dacia dealership under a single rooftop would count as two franchise points, as would Ford and BYD. Most manufacturers don’t have this level of understanding themselves in a structured way, so we stick to what they do know – franchise points by brand.

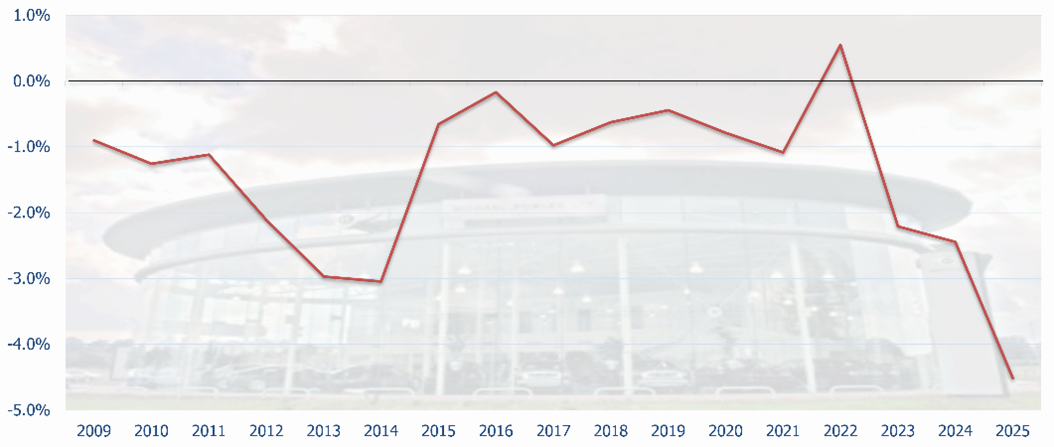

Over the years that we have been publishing ECDH, the actual decline in the size of networks for what we call ‘continuing brands’ i.e. those that have been a fixture over the years, excluding new entrants and those that have departed, has been at an almost glacial pace – less than 1% per annum per year. Over time this still adds up – the number of franchise points supporting those continuing brands has dropped from 42,951 to 37,401 over the last decade, a total drop of 12.9%. This has been compensated for in part by the arrival of new brands, not only from China, but also Tesla (with a direct sales model) and new sub-brands from the non-Chinese brands such as Cupra being added to the VW Group portfolio. When these are included in the numbers, the reduction in total franchise points has been only 4.9%

Simply extrapolating that slow decline in the networks of the continuing brands forward would imply that the structural disadvantage of European dealers compared to their peers in some other parts of the world would continue. However, in the last two years – as shown in the chart that accompanies this blog – the year-on-year change in the number of franchise points for the continuing brands in EU and UK was over 2% in each of 2023 and 2024, and then reached 4.5% in January 2025 versus January 2024. These three years account for three quarters of the total drop in the last decade. This raises the question of whether this significant change in pace is manufacturer led, or dealer led? Are the established manufacturers taking on board the various points that we have made over the years related to operating costs, investment pressures and adjustments to support omni-channel – or are dealers choosing to exist the business completely, or stay in business but switch some properties over to newer brands, leaving the established brands with many open points, i.e. areas where they would like but lack representation?

My impression when I speak to both manufacturers and dealers is that the trend we have seen in the last three years is not a ‘blip’ and that the rate of decline in the networks of the established brands has accelerated and will continue at a similar pace for at least another two to three years. This reflects the implementation of what some call ‘ideal’ network strategies where there is a net reduction in network size, though often accompanied by changes in the franchisee and some investment in new, typically larger facilities. Where this is giving the franchisee the opportunity for higher returns, then this is entirely consistent with what ICDP has been recommending for some years.

Overlaid on this however, is a pattern of dealer investors choosing to reduce or exit from their representation of declining brands – therefore contributing to the reductions seen in the last three years, and leaving those brands with open points – but signing up instead with some of the new entrants. These additions to new networks compensate for around two thirds of the decline for established networks.

Overall, network numbers are therefore likely to show a continuing slow but steady decline, but within that total, the mix is going to change, initially with more brands, although perhaps in time, their numbers will also start to decline as both established and new entrant brands leave the market. So like the proverbial swan, steady visible progress overall, but lost of activity beneath the surface.

If you would like more details on the European Car Distribution Handbook, look HERE or contact projectoffice@icdp.net